Making the leap into entrepreneurship can be both exciting and scary at the same time. The excitement that kicks in centers around the ability to do something you’re really passionate about and love; whereas, the fear of financial stability and even failure are all a part of that decision. In fact, 65% of entrepreneurs cite that cash flow issues are a big reason for failure.

There are two ways that you can jump into entrepreneurship:

- Start a side hustle so you can test the waters first without losing the income of your day job.

- Go all in using the capital you may have saved up or raising capital to fund your business.

In this day and age, starting a business is easy (46% of Americans think so too) — however, scaling as well as sustaining the business is much more challenging. For this, it’s common to see 50% of small businesses fail in the first four years.

So how do you know if you’re on the right track to turn your side hustle into a full-time gig? Today’s blog post will focus on answering this question, but let’s first quickly touch on why the growth of the side hustle has been such a big deal in recent years.

Why People Love Side Hustles

The side hustle era isn’t just a way to earn extra cash — for many, it has become a new way of life.

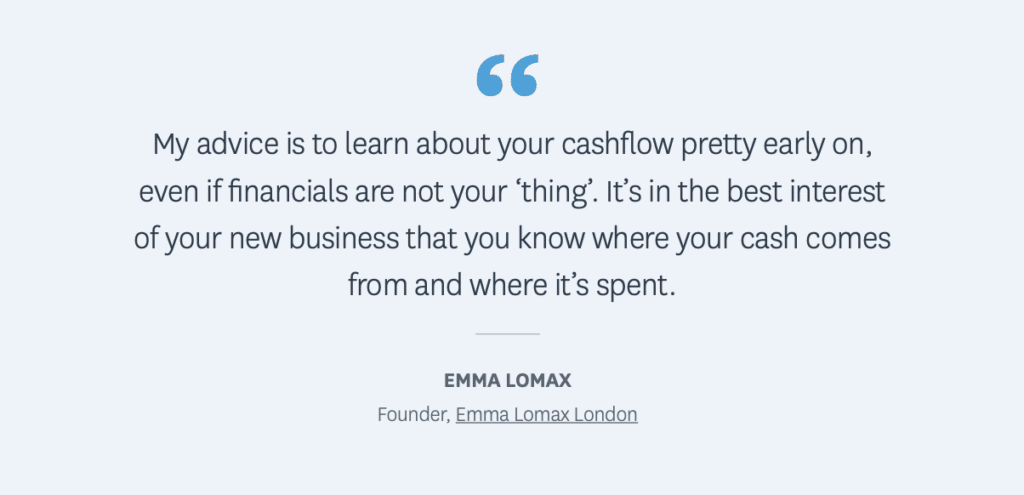

Recent data from Bankrate shows that roughly 45% of all U.S. workers have some form of side gig. The trend is particularly popular among Millennials, with nearly one in two relying on the practice to boost their earnings.

For many people, side hustles provide much-needed income. But for others, starting a side gig is the first step toward something bigger, better, and yes, more profitable.

Bankrate notes that despite a strong economy and record-low unemployment, many workers are still living paycheck to paycheck. Nearly three out of 10 people with a side gig are using the funds to help cover regular living expenses, a result attributed to flat wages and a rising cost of living. Some call it a “shadow of the earlier financial crisis,” where unemployment reached as high as 10.2% in October 2009 — and many are still trying to recover financially from the fallout.

Regardless of your current financial situation, the side hustle economy is helping budding entrepreneurs get their feet wet in business ownership. It has opened the doors for thousands of people to follow their dreams of starting a business and becoming their own boss — a dream shared by 62% of American workers.

Pro Tip: Starting a side hustle? Use BlueHost to get your website running. BlueHost has a 1-click WordPress install and a free SSL certificate, with prices starting under $4 a month. Check out their features here.

You’re Making a Six-Figure Income

This might seem obvious, but the truth is for many, making six figures is a good indicator that you’re ready to turn your side hustle into a full-time gig — that you can also scale beyond just six-figures. You can even position this to say that you’ll go full-time with your side hustle when your income exceeds your day job’s income.

Now making that transition won’t be immediate in many cases, because these are the important factors you have to nail down first:

- Are you in a position to consistently make this type of income beyond a short-term period? In other words, is the market demand there that you can truly scale?

- You are well-versed with the financials of your side hustle and have a clear financial model that will make sure you keep moving forward.

- You have a healthy balance between paying yourself and also investing back into the business for growth without hurting your current lifestyle.

Know the Numbers Like the Back of Your Hand

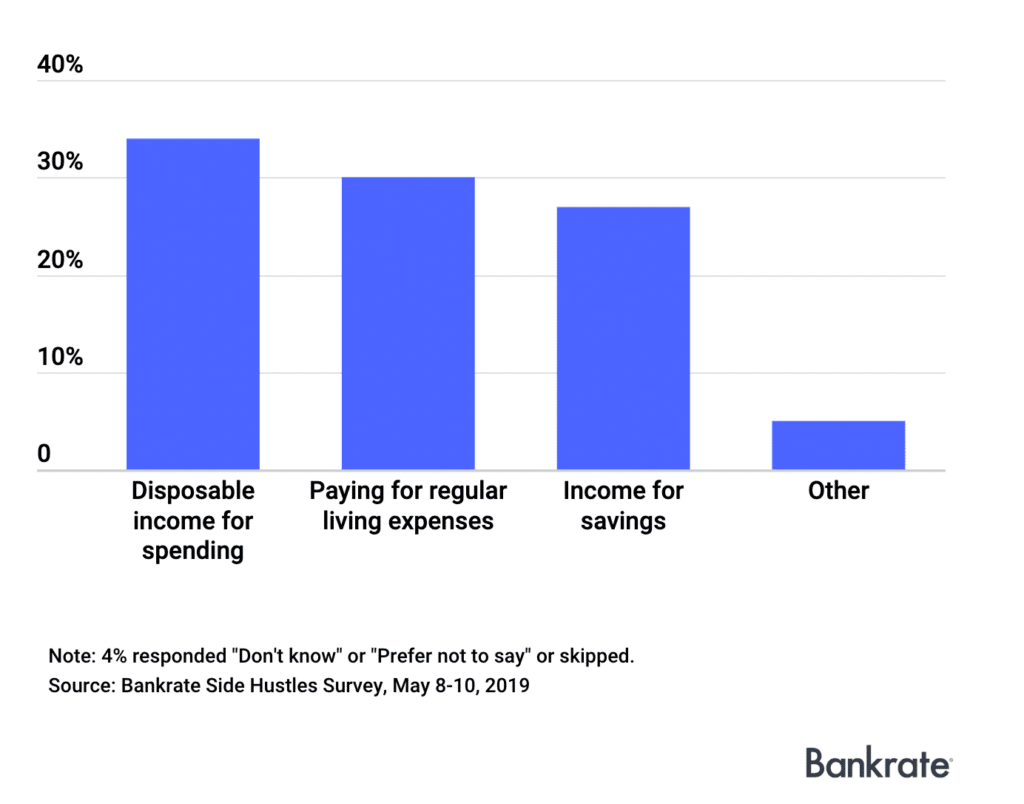

In the same vein as developing a legit financial plan, knowing the current financial status of your side hustle is going to be the most important thing you do.

You can have a profitable business and still run out of money, and without cash flow, you can’t afford to operate. Studies show that most entrepreneurs underestimate their capital needs by as much as 200%. Even if you’re doing everything else right, poor cash flow can be enough to kill your business and send you to the unemployment office.

As you’re working your side gig, you’ll start to see how much money is coming in and going out. But understand that these numbers may shift significantly once you go full-time.

More time to work your side gig means more customers and income, but it also means more expenses and overhead. You’ll need to invest more in marketing. You may need to pay for office space or a storefront. You’ll have to worry about taxes, business insurance, and all the other little fees that crop up when you go from side hustler to full-time business owner.

If financials aren’t your expertise, there are many well-qualified freelancers available to help you manage your books and come up with a solid financial plan. Fiverr is a great place to find high-quality freelancers — and their work is guaranteed. Freelancers on Fiverr can help not only with your finances, but also build websites, manage social media, write blog posts, and many other things. For a complete list of offerings, visit their website here.

Your Marketing Efforts are Working

Outside of generating revenue that yields a healthy profit margin, marketing should be at the forefront of everything you do and be held with the highest of priorities. Smaller efforts such as blogging, running search and social ads, and doing email marketing are all great places to start, but you’ll know that they are working if they are contributing to your revenue goals too.

Side note: Check out my blog post on how I generated a 603% ROI with a single blog post.

The role that marketing will play in helping you do the following will have a great compounding effect that can benefit you in the years to come. Here are some tactics you should focus on:

- Building out your brand and its equity.

- Pushing out relevant content your target audience wants to consume that also builds trust. In turn, this will increase new sales and keep loyal customers on board.

- Driving targeted website traffic that become subscribers, leads, and ultimately sales.

- Allowing you to expand your reach, especially with your digital footprint.

- Being both purpose and data-driven.

Wrapping It Up

Building a successful business will take time and that’s why I always recommend you do something you love because patience will be a big part of the process. Without that love for what you do, you’ll lose the drive and motivation to keep going.

Look at entrepreneurship as a marathon, not a sprint. Merge your passion with practicality so that you can be sure to excel your business and the vision you have for it to last beyond just a few years.

Finally, make sure that once you decide to take the leap from a side hustler to a full-time business owner, you push to make it a lifestyle. Doing so will help you navigate the needed integration for a work/life balance.

Disclosure: Please note that some of the links above are affiliate links. I only recommend products and services that I use and stand behind, and if you decide to try them, I will earn a commission at no cost to you. Doing so helps me run this blog and provide free content for you, my readers.