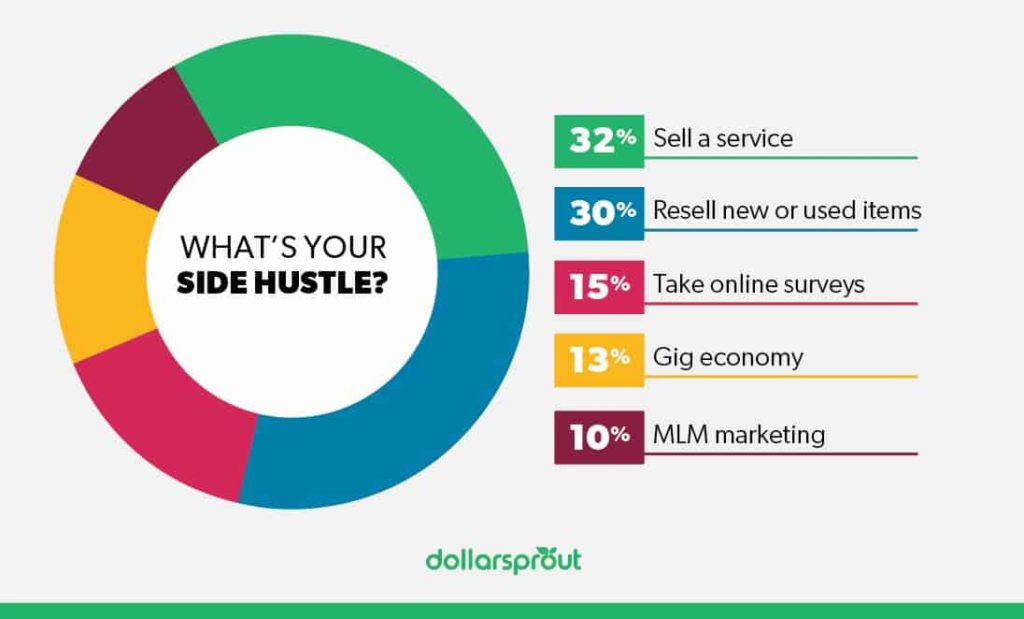

Few people are lucky enough to say they love their full-time day jobs, which is likely why nearly half of all Americans have some form of side hustle. Of those, 43% also work full-time somewhere else, while 51% are employed part-time. And compared to just over half who enjoy their primary job, a whopping 76% say they love their side gig.

In either case, many workers eventually want to turn their side gig into a full-time income and leave their old job in the dust. They crave the freedom of self-employment and get excited at the prospect of earning a higher salary. In fact, the top 14% of people with a side hustle are earning $500 or more per month — and that’s just part time! Imagine what you could do if you could invest 40 hours or more.

But let’s be real: making the leap from the comfort of a paycheck into unknown territory can be downright scary. There’s no guarantee you’ll make more money than you already do, and even if you do manage to get a pay boost, there’s no guarantee for sustainability.

Being an entrepreneur is work ― hard work ― but it’s not impossible to turn a side job into a profitable, fully functioning business. With the right knowledge, process, and plenty of determination, you can increase your chances of turning your modest dream into a brag-worthy reality.

Here’s how:

Be Honest with Yourself

Studies show that 15% of Americans are working a side hustle with the intentions of turning it into a full time job. You have your own reasons for wanting to venture out on your own. The key thing here is that you are smart with how you make the transition by ensuring that you are generating income to replace your full time job.

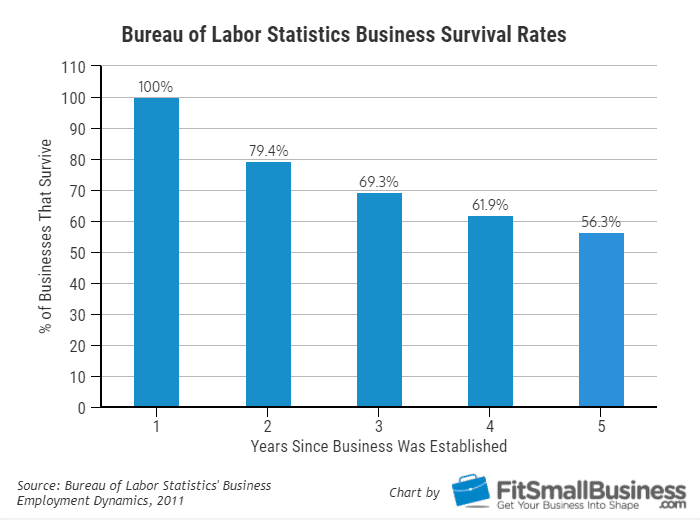

About 20% of all small businesses fail within their first year. By the second year, that figure reaches 30%, and by the fifth year, only half of small businesses will still have their doors open.

Before you dive headfirst into a business, be honest with yourself: Do you have what it takes to overcome the common struggles of a small business?

Small business owners wear multiple hats, from marketing to operations to accounting and more. You can always outsource the tasks you don’t feel comfortable with, but this requires having enough cash on hand to do so and ensuring you’ll see a return on your investment. Plus, you need to know enough about anything you outsource to ensure the person handling it is doing an effective job.

This step is the first step because you’ll often need to face hard realities. Being honest with yourself can be challenging, especially if your dreams are speaking louder than your logic.

But once you decide that going from side hustle to full-time gig is the right move, don’t drag your feet. Research shows you’re 91% more likely to achieve a goal if you put a deadline on it, so decide when you want your business to go live and get to work.

Do Your Market Research

The reasons so many small businesses struggle to survive are varied: They can’t manage cash flow. They don’t know how to market themselves. They can’t retain employees. They lack operational know-how, are bested by competitors, or don’t price their products or services accordingly.

But the biggest cause of failure is lack of market need. Nearly 42% of small businesses can’t find a profitable niche or are entering a saturated market where there isn’t enough demand for their services. Without demand, there are no customers. And without customers, there is no revenue.

How exactly do you go about testing your viability in the market?

To start, think about the businesses or customers you plan to serve. Go out and talk to them and ask them about their pain points, then think about how you can make yourself valuable by solving them.

This exercise can also lead to developing strategic partnerships. Nearly 100% of entrepreneurs agree that face-to-face meetings are essential in developing long-term relationships. You can leverage your network to gain new opportunities, meet new people, and grow your business.

In addition, you’ll want to explore advertising and marketing opportunities. Think about how you will promote your services. Look at the effectiveness of different types of media and their associated costs.

Last but not least, you’ll want to do a little recon on your competitors. Who are they, and what do they do well? What’s their reputation? More importantly, what are their weak areas, and how can you potentially pick up the slack?

Knowledge is power, so the more you know about how to set yourself up for success, the better chance you’ll have of making an impact in the industry.

Look at the Numbers

You can have a profitable business and still run out of money, and without cash flow, you can’t afford to operate. Studies show that most entrepreneurs underestimate their capital needs by as much as 200%. Even if you’re doing everything else right, poor cash flow can be enough to kill your business and send you to the unemployment office.

As you’re working your side gig, you’ll start to see how much money is coming in and going out. But understand that these numbers may shift significantly once you go full-time.

More time to work your side gig means more customers and income, but it also means more expenses and overhead. You’ll need to invest more in marketing. You may need to pay for office space or a storefront. You’ll have to worry about taxes, business insurance, and all the other little fees that crop up when you go from side hustler to full-time business owner.

Don’t be conservative in your estimates. If anything, it’s best to overestimate your expenses and cash flow needs. Talk with other business owners about their finances to get an idea of what you might end up paying for things like utilities, leased space, and other expenses. Ask them about any surprise expenses they’ve encountered and how they weathered financial storms. You can learn a lot from others’ past mistakes, so take advantage of their expertise.

Develop Your Business Plan and Goals

Do you need a business plan? Many business owners say don’t waste your time, but research suggests differently; one study found that writing an official business plan can help you grow 30% faster than companies that don’t plan.

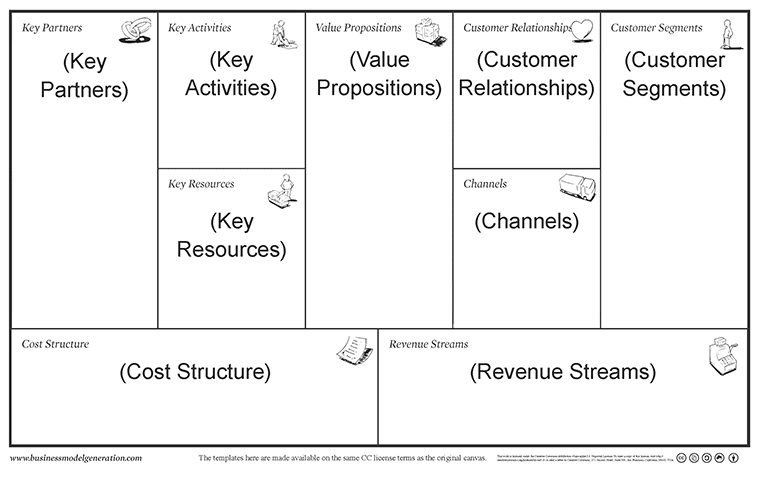

Think of your plan as a blueprint: It defines your business’s purpose, mission, and values, along with a strategy on how to grow.

And with a plan in place, you can set goals and benchmarks to measure your progress. A Harvard Business study found that 83% of people have no goals. The 17% who do set goals are 10 times more successful than those who don’t. And the 3% who write down their goals are 3 times more successful than those who set goals but don’t write them down.

As an entrepreneur, a business plan and clear goals can serve as your lighthouse to success, guiding your intentions and helping you prioritize the right activities.

Invest in Financial Protection

Every business faces some form of risk. But surprisingly, 31% of people do not have insurance for their side hustle. If you want to make your side gig a legitimate business, you’ll want to minimize your amount of financial risk as much as possible. Small business insurance can protect you from potential lawsuits, natural disasters, or other factors that may impede your revenue.

Make It Official

As a small business owner, you’ll need to take the proper steps to turn your gig into a real business. This could require obtaining a business license and related certificates, getting an LLC or other incorporation, and paying quarterly taxes, among other things. The more you make your business look legitimate, the more seriously others will take you.

How to Decide When to Quit Your Day Job

At this point, you’ll have laid a lot of groundwork for turning your business into a full-time income. The last thing you need to do is choose when to exit your job and become your own boss.

There is no “right” time, per se, but something to consider is that when you leave, you’re on your own for income. Ideally, you’ll have several months’ worth of expenses saved up in case growth is slower than you planned.

It’s a wise idea to wait until you’re making almost enough to replace your income OR you’ve reached the point where you can’t grow your business until you can devote more time to it. My best advice is to keep your side hustle on the side for several months to ensure you truly love what you do and won’t burn out or change your mind after a few months.

But when you’ve done your homework and know in your heart that it’s time to make the leap, nothing will be able to hold you back from the success you deserve.

2 Responses