On March 23, 2020, the Dow Jones Industrial Average closed at 18,341.06, having lost more than a third of its value since the beginning of February. Yet while the headlines have generally focused on big businesses, small businesses are suffering as well, and many of them do not have the same ability to absorb sudden shocks such as those caused by COVID-19.

Small businesses comprise any business entity that has under 500 employees, and they are responsible for around 46.8% of private-sector payrolls as of 2016. They make up a slightly smaller fraction of the GDP, but it’s still clear that the success of America relies equally on big business and small businesses alike.

With this in mind, the US government passed the Coronavirus Preparedness and Response Supplemental Appropriations Act on March 6, 2020 and the Families First Coronavirus Response Act, which was signed into law on March 18, 2020. These make some provisions for small businesses, providing support when they need it. As President Trump said, the United States is “not built to be shut down,” possibly his least controversial statement ever.

While these are helpful, there are also other forms of support for small businesses out there as well.

The Coronavirus Preparedness and Response Supplemental Appropriations Act

This initial act delivered $8.3 billion in emergency funding, including loans for small businesses. These are funneled through the Small Business Administration, specifically through its Disaster Loans Program Account. The applicable loan type is an Economic Injury Disaster Loan. These loans provide up to $2 million per small business and can cover one of the following:

- Working capital needs

- Normal business operating expenses

For COVID-19, it’s most likely that normal business operating expenses would need to be covered by the loan. The interest rate for these loans is currently:

- 2.75% for nonprofits

- 3.75% for small businesses

The repayment period of the loan can be as long as 30 years, depending on your needs.

These loans need to be thought about carefully, as businesses operating on already-thin margins may find that the repayments also put their livelihood at risk. As a rough example, a $1 million loan over 30 years to a small business would:

- Cost $4,634 per month

- Result in a $1,668,177 total repayment

- Total $668,177 of interest ($22,272.57 of extra expense per year spread over 30 years)

This also assumes that interest rates stay the same. Shortening the loan, of course, results in less interest paid, but it’s still a potential burden.

If you think that this type of loan meets your requirements, you can apply for SBA Disaster Loan Assistance here and get further information on it.

Small Business Support Offered by the Families First Coronavirus Response Act

Any business that has fewer than 500 workers must pay up to 12 weeks of FMLA leave for coronavirus-related issues. Businesses with fewer than 50 employees may be able to apply for an exemption if they qualify and the additional leave would create significant hardship. Initially, employees get:

- Full pay for 2 weeks if sick themselves or under a quarantine order due to COVID-19

- Two-thirds pay for 2 weeks if caring for another

Then, they get two-thirds pay for another 10 weeks if caring for another. All of these are subject to dollar caps ($200 per day if caring for another; $511 per day if ill).

These are initially paid for by the employer, but you can recoup them through a dollar-for-dollar payroll tax credit. This credit, therefore, doesn’t kick in until you have to pay payroll taxes, so it may create additional temporary hardship. However, the funds will be paid back through this mechanism.

Freelancers and other self-employed workers are also eligible for tax credits if affected by COVID-19.

US Chamber of Commerce Foundation

The US Chamber of Commerce Foundation offers help with setting up an Employee Assistance Fund to assist employees with unexpected hardship. These funds can be professionally managed through a non-profit partner so that they are ready if employees need them. By using an external nonprofit partner, the company can cover different types of hardship and ensure the money goes where it’s needed.

If you haven’t already established one, it might be time to do so. These funds can help employees recover from the effects of COVID-19 and can potentially provide additional healthcare support.

Facebook Small Business Grants Program

Perhaps one of the more unusual grant programs is the one offered by Facebook: its Small Business Grants Program. The company is putting forward $100 million in cash grants and advertising credits to help businesses during this outbreak. This amount will be spread over 30,000 companies in 30 countries, and it’s aimed at small businesses in particular.

At the time of writing, uses of the grant could include:

- Covering operational costs

- Covering rent costs

- Paying the workforce

- Connecting with new customers online

The details are vague, likely because Facebook hasn’t quite finalized them yet. However, this could be a promising light in the darkness for some companies, and it’s worth keeping an eye on.

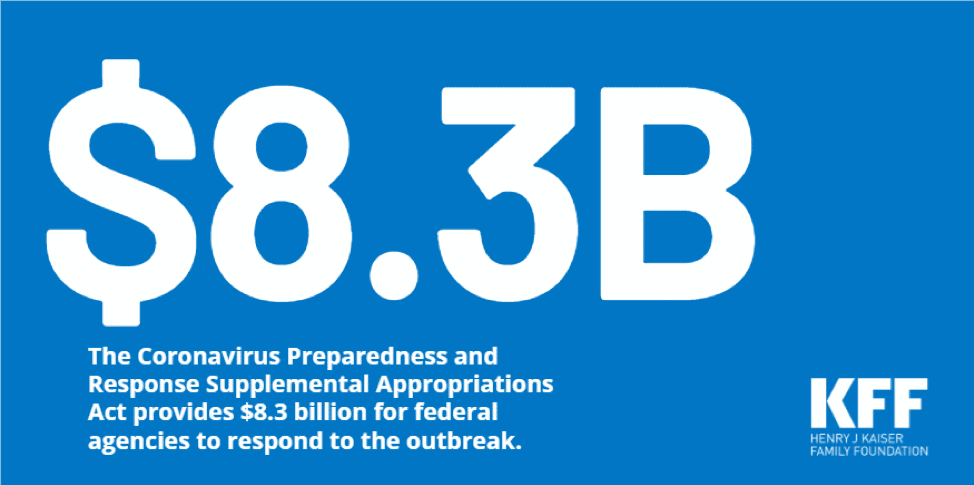

Yelp and GoFundMe Partnership

Yelp and GoFundMe have partnered to give patrons a chance to donate to small businesses using the Yelp app. As long as you have claimed your Yelp page, they will automatically be adding a donate button to your profile.

In addition, Yelp and GoFundMe will match funds up to $1 million. One important detail is that in order to receive your donations, you must claim your page on GoFundMe, so make sure to take advantage of that opportunity.

CDC and OSHA advice

While there is a lot of information on COVID-19 online, some of it is less than helpful. The Centers for Disease Control has some useful interim guidance for businesses and employers to help with planning. These documents help provide suggestions on ways to:

- Prepare the workplace for a COVID-19 outbreak

- Reduce transmission

- Employee education

- Maintain healthy business operations

In addition, there are guidelines for disinfection, OSHA requirements, and further resources.

The OSHA also has extensive advice on preparing your workplace for COVID-19. This large 35-page document starts becoming relevant on page 7, the first six pages being preamble.

Both of these resources are helpful for small businesses, as they aim to help reduce the chance of your employees becoming sick. If your employees do become sick, these resources offer ways to mitigate that while addressing the concerns of running a business.

State Programs

Different states have different programs for addressing and mitigating the effects of coronavirus. While many states offer assistance only for individuals and employees, some do offer additional assistance to small businesses.

Alabama

Alabama is providing relief to businesses that cannot pay their February, March, and April 2020 sales tax liability in a timely manner. The sales tax would be paid back using a payment plan at a later date.

California

The League of California Community Foundations has a variety of funds that small businesses may be eligible for.

Businesses in San Francisco with at least one but fewer than six employees may be able to get help through the COVID-19 Small Business Resiliency Fund.

Colorado

In Denver, the Denver Economic Development and Opportunity (DEDO) is setting up an emergency relief program to provide small businesses with cash grants up to $7,500. DEDO, in partnership with CEDS Finance, will also help small businesses by refocusing an existing microloan program and allowing businesses to temporarily defer loan payments if necessary.

Florida

Businesses in Florida can apply for loans of up to $100,000 through the Florida Small Business Emergency Bridge Loan Program. While the interest rate is initially zero for 12 months, it rises to a staggering 12% after that.

Massachusetts

The Massachusetts Growth Capital Corporation set up the 2020 Small Business Recovery Loan Fund to provide low-interest loans of up to $75,000 for small businesses and nonprofits with fewer than 50 employees.

Maryland

Two major state programs help small businesses, with the Maryland Small Business COVID-19 Emergency Relief Loan Fund providing business loans with no interest or principal payment due for 12 months and the Maryland Small Business COVID-19 Emergency Relief Grant Fund providing grants of up to $10,000 for businesses with 50 or fewer employees.

New York

New York City has two programs: the NYC Employee Retention Grant Program and the NYC Small Business Continuity Fund. The former is a grant for up to 40% of payroll for two months for businesses with fewer than five employees. The latter is a no-interest loan of up to $75,000 for businesses with fewer than 100 employees.

Washington

Seattle currently offers a 2020 OED Small Business Stabilization Fund to help small businesses with five or fewer employees. It offers grants of up to $10,000.

What Small Businesses Should Know About Marketing and Google Ads

As the workforce and more consumers start going online, take advantage of being present digitally too. Every penny counts and it’s still good to ensure that if possible, some money is allocated to reaching your target customers, driving traffic back to your website — with a personalized message about how your business is handling the pandemic— and then offering discounts to aid sales. For a more detailed approach about marketing amid COVID-19, check out my recent blog post.

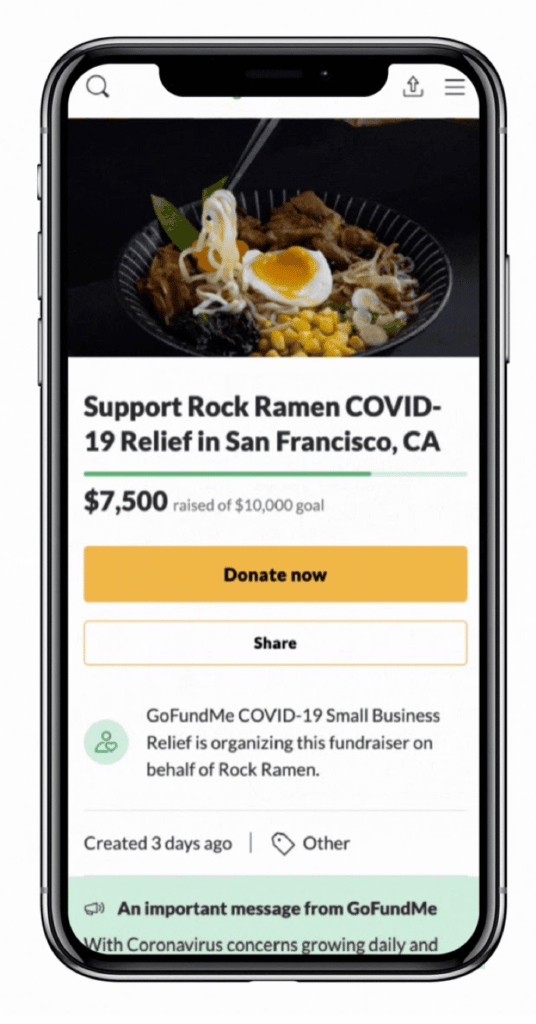

That being said, here are some quick stats to be aware of if you decide to still have a presence with your digital ads, specifically on Google. With larger companies like Amazon pulling back on their ad budget, you’re seeing a 9% decrease in CPC.

In recent days, Google’s search ad impressions have decreased by 7%, while conversion rates have dropped by 21%. However, this varies by industry. Non-profits and charities have had an increase in ad impression and conversion rates, along with business management and financial resources. Industries that have had the sharpest decline in conversion rates are travel and tourism, conferences, and bars and restaurants.

Plenty of Help for Small Businesses

This is far from a comprehensive list of small business resources, and as the outbreak deepens, it’s likely that further federal, state, and city-level funding will become available. The outbreak is a serious one, and small businesses in particular will feel the brunt of it.

With good planning and good use of the resources above where possible, you can help your business weather this storm. As you weather the storm, it might be wise to focus on the future, and what you will do when this passes to ramp up business.